Government emphasises spending to bolster economic recovery underway. IN BRIEF $106.6 billion deficit with net debt to peak at $980.6...

Read MoreThe amount of superannuation you should have is a culmination of the contributions made into your super account, fees deducted from your account and the investment earnings within your account.

Contributions made into your super account may consist of employer contributions, salary sacrifice contributions, or personal (deductible or non-deductible) contributions.

Investment earnings are allocated to your member balance, based on the income derived and the capital gains achieved from your superannuation investment portfolio.

Fees within your account may be payable to your superannuation provider for administration and compliance. You may also be paying other fees, such as fees to a financial planner for strategic and investment advice relating to your super.

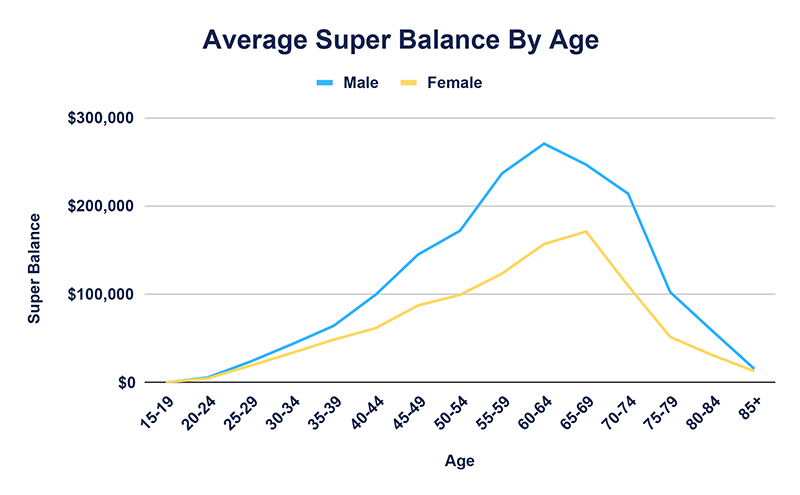

The chart below illustrates the average super balance by age for men and women. Comparing your balance against the average can give you an indication as to where your balance stands compared to your compatriots.

In reality, the amount of super you should have is much greater than the average super balances shown in the chart above and the table below. If you were to merely track along with the average Australian super balances, you would be a far-cry from enjoying a comfortable retirement.

The amount of super you should have at your age depends on the age you intend on retiring at and how much super you are relying on to meet your retirement income objectives.

While comparing your super balance against other people your age does provide you with some indication of how you are placed, such a comparison is irrelevant in helping you achieve your retirement goals.

You are an individual with specific and unique objectives and desires. There are a myriad of factors that determine how much super you should have at your current age, such as your salary, whether you are an employee or self-employed and whether you have a bias to building wealth either inside or outside of super; to name a few. This is why it’s important to not be overly concerned with how much super you should have at a given age.

But, if you insist on correlating how much super you should have at your age with the average superannuation balance by age, then the table below can be used as a guide.

Who cares how much super you should have at 30? The average male 30 years old will have about $33,000 in super and the average female will have about $26,000. But if you’re 30-years old and worried about how much you should have in super, then you need to get a life!

By the time you’ve reached 40, you’ve probably questioned your choice of profession at least a dozen times, you may have even switched careers by now. But one thing is certain, you are still many years away from being able to access your super. So, stop thinking about retirement and start thinking about how to lead a more fulfilling life between now and then.

A 40 yar old female in Australia will have around $55,000 in super and a 40-year-old male will average $82,000 in super.

Okay, so now is about the age where it’s time to start getting serious about your super. You’re probably at or around your peak career earnings, your kids have flown the coop and your savings capacity is at an all-time high. It’s time to escalate your investments for your impending retirement.

The average super balance for 50 years old men is $158,000 and $93,531 for women. But realistically that means bugger all. What’s really important is that you have your own personal financial plan in place, and you know exactly where you’re going and how you’re going to get there financially.

If you’re 60, you’ve arrived! It’s time to push back that colonoscopy appointment and check-in with your super, because as soon as you blow out those 60 candles there are dozens of doorways that open for your super. Whether you’re working full-time, part-time or not at all, there will be at least one way you can begin using super to your advantage. Don’t delay, super strategies can be very beneficial between the ages of 60 and 65 and, believe me, you want to get onto it as soon as possible.

A female aged 60 in Australia will have an average super balance of $140,000 and a male age 60 will have around $254,000, but I know you can do better. That’s why you’re here, right? You want to learn the tips to boosting your super. Well, come on in!

The average super balance for 50 years old men is $158,000 and $93,531 for women. But realistically that means bugger all. What’s really important is that you have your own personal financial plan in place, and you know exactly where you’re going and how you’re going to get there financially.

What is retirement? The retirement definition is evolving. Gone are the days of working with the same company for 35-years, then hanging up the boots and getting your gold watch. Retirement now involves reducing working hours, transitioning to retirement, accessing a bit of super here and there, doing some casual or consulting work on the side and then finally, eventually stopping work all together.

Because of these varied definitions of retirement, it is difficult to pinpoint an average super balance at retirement. But, if we agreed that, say, age 65 was a retirement age, then the average super balance at retirement is $270,000 for men and $157,000 for women.

A female aged 60 in Australia will have an average super balance of $140,000 and a male age 60 will have around $254,000, but I know you can do better. That’s why you’re here, right? You want to learn the tips to boosting your super. Well, come on in!

The average super balance for 50 years old men is $158,000 and $93,531 for women. But realistically that means bugger all. What’s really important is that you have your own personal financial plan in place, and you know exactly where you’re going and how you’re going to get there financially.

The amount of super you should have to retire is determined by three factors:

Your first step is to use a retirement calculator to determine how much super you expect to have a retirement. You then want to calculate how much income that super balance can provide you with throughout retirement. This is your starting point.

From there, you should then see how working longer, retiring sooner, increasing/decreasing retirement income or increasing/decreasing investment risk affects your retirement income and the longevity of your balance.

Retirement research shows that a couple requires $640,000 (combined) in superannuation and a single person needs $545,000 to enjoy a comfortable retirement.

A comfortable retirement lifestyle is defined as an income of $61,909 p.a. for couples and $43,687 p.a. for singles (increasing with CPI), including expenses such as leisure activities, a good standard of living, private health insurance, a reasonable car and electronic equipment, as well as domestic and international travel.

An employer is required to make superannuation guarantee (SG) payments to employees on at least a quarterly basis. The current SG rate is 9.5% of your pre-tax salary or wage. For example, if your annual wage is $80,000, you should receive employer contributions of $7,600 for that year.

There are a number of ways to boost your super. This can be done through additional super contributions, reviewing your superannuation investments or reducing your super fund fees.

Types of additional contributions include salary sacrifice contributions, personal concessional contributions and personal non-concessional contributions.

It’s important to seek advice to ensure you are making the right type of contributions to meet your needs and that you stay within the contribution limits.

Government emphasises spending to bolster economic recovery underway. IN BRIEF $106.6 billion deficit with net debt to peak at $980.6...

Read MoreRegardless of how far off retirement is for you, it could be beneficial to regularly check that your finances are...

Read MoreNot surprisingly, there’s been a significant spike in the conversation around Superannuation lately. Whether it’s protecting your growing nest egg...

Read More